Introduction

On 13 June 2025, Israel launched Operation Rising Lion, a large-scale air and drone strike against Iran’s nuclear and military infrastructure. Israeli jets hit sites including the Natanz uranium enrichment complex, the Fordow underground facility, and a nuclear research centre in Isfahan. The strikes also killed several top Iranian commanders – among them IRGC General Hossein Salami, Armed Forces Chief Gen. Mohammad Bagheri, and missile program head Gen. Amir Ali Hajizadeh – dealing a severe blow to Iran’s military leadership. Iran swiftly retaliated with Operation True Promise III, firing dozens of ballistic missiles and over 100 armed drones at Israeli cities including Tel Aviv and Jerusalem. (Israel’s military reported fewer than 100 missiles were launched and that most were intercepted or fell short, though Iranian state media claimed “hundreds” were fired.) Israel’s multi-tier missile defences – Iron Dome, David’s Sling, and Arrow – did intercept the bulk of the incoming salvo. Even so, a number of missiles penetrated the shield. Some struck the Tel Aviv area, Rehovot, and other targets, resulting in serious casualties on the Israeli side. By the second day of attacks, at least 11 Israelis had been killed and over 200 injured in the Iranian barrages. This exchange – unprecedented in scale – marks a major escalation of the Iran–Israel conflict and raises urgent questions about Iran’s missile capabilities and evolving technology, particularly its new hypersonic weapons.

Iran’s Layered Missile Arsenal

Iran possesses a diverse and increasingly sophisticated missile force, with several thousand ballistic missiles spanning short to medium ranges. Its arsenal includes road-mobile, solid-fuelled short-range missiles like the Fateh-110 (~300 km range), Fateh-313 (~500 km), and Zolfaghar (~700 km). These highly mobile SRBMs can be launched from transporter-erector-launchers (TELs) that are easily concealed or repositioned, complicating an adversary’s efforts to detect and pre-empt them. Medium-range systems – the Shahab-3 (~1,300 km), Ghadr (~1,600 km), Emad (~1,700–1,800 km), and the two-stage solid-fuelled Sejjil (~2,000 km) – extend Iran’s reach to about 2,000 km, covering all of Israel and much of the Middle East. Iran’s newer MRBMs include the Khorramshahr series (approximately 2,000 km range with a 1.5-ton warhead) which, if fitted with a lighter payload, could potentially strike targets up to ~3,000 km away. Notably, while older medium-range missiles like Shahab-3 and Ghadr are liquid-fuelled, Iran has increasingly embraced solid-propellant technology for quicker launch readiness and easier storage (the Emad and Khorramshahr remain liquid-fuelled, whereas the Sejjil, Haj Qasem, and new “Kheibar Shekan” are solid-fuelled). These missiles are dispersed on mobile launchers and hidden in hardened bunkers or underground sites, including extensive “missile cities” – networks of tunnels sheltering TEL trucks and support equipment deep under mountains. Such measures make Iran’s missile units difficult to detect and destroy pre-emptively, as launchers can be shuffled between underground silos and disguised transporter trucks. Overall, Iran’s layered arsenal provides the ability to strike targets from a few dozen kilometres to a couple thousand, creating a threat envelope that encompasses U.S. bases in the Gulf, Israel, and even Southeastern Europe.

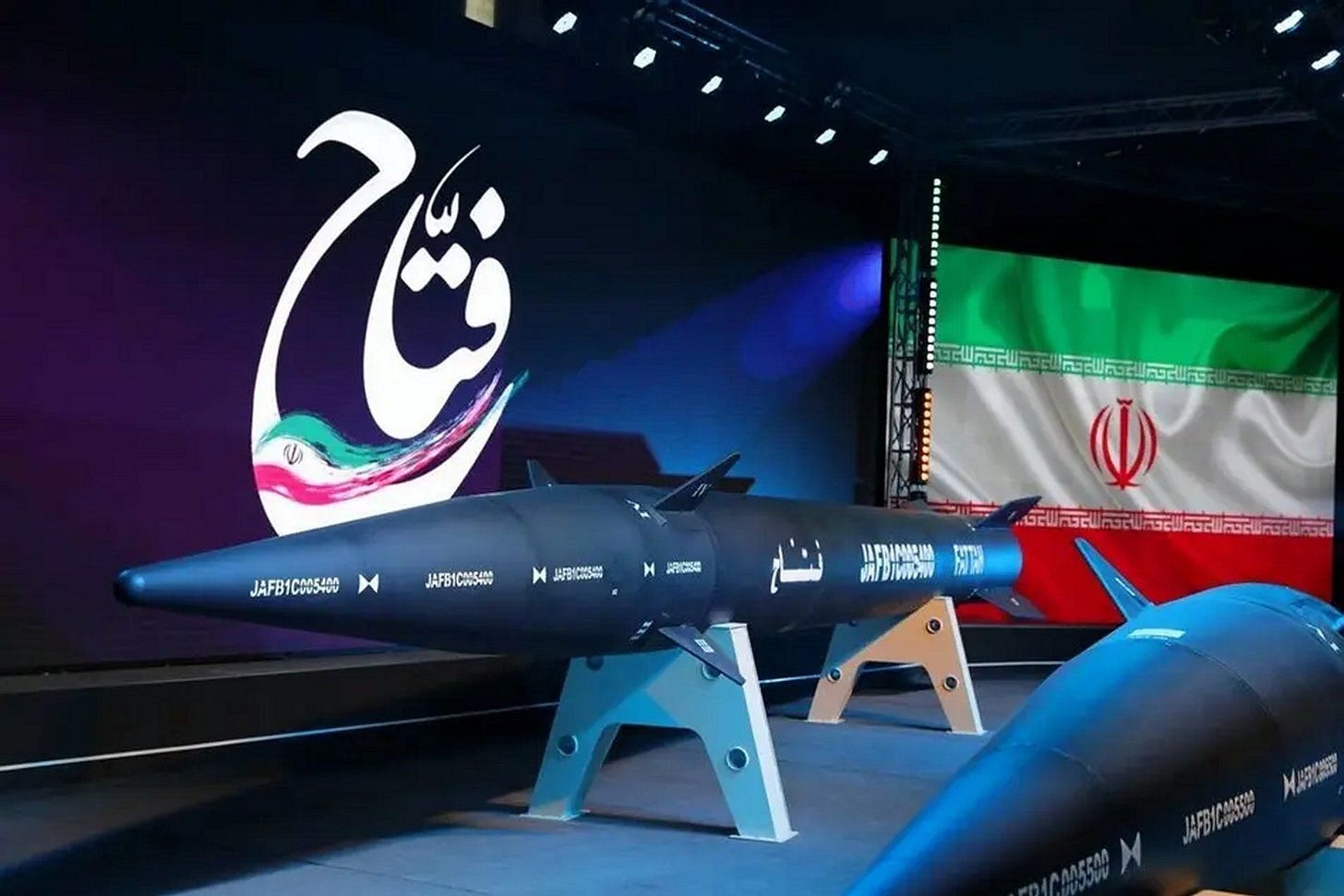

Advancement: Hypersonic and Manoeuvrable Systems

Iran’s most alarming technological leap is in hypersonic and manoeuvrable warhead technology, aimed at defeating even advanced missile defences. Tehran’s showcase system is the Fattah family of medium-range hypersonic missiles, unveiled with great fanfare. Fattah-1, revealed in June 2023, is Iran’s first operational hypersonic MRBM. It is a two-stage, solid-fuelled missile about 15 m long and ~12 tons in weight, carrying a 350–450 kg high-explosive warhead. Fattah-1 has a reported range of ~1,400 km and can reach peak speeds of Mach 13–15 during its mid-course and re-entry phases. At such speeds (over 5 km/s), it could theoretically traverse the distance from Iran to the Mediterranean in under 10 minutes. More importantly, Fattah’s re-entry vehicle is a manoeuvrable warhead (MaRV) that can make abrupt trajectory changes in its terminal phase. This weapon’s combination of extreme velocity and evasive flight profile makes interception highly challenging for conventional defence systems. Israeli and Western defence analysts note that Fattah’s high terminal speed drastically compresses the defender’s reaction time, while its mid-course manoeuvres can confound missile defence radars that assume a predictable ballistic arc. Indeed, Iranian officials boast that Fattah “cannot be destroyed” by any existing anti-missile system – a claim that, although likely exaggerated, underscores the serious concern this missile has created in Israel. Notably, during Iran’s large-scale missile volleys in October 2024 and June 2025, Western observers believe a few manoeuvrable warheads (possibly Fattah or similar) did slip past Israeli defences, resulting in deadly impacts. Iranian sources have gone further, claiming that their new missiles would have a mere ~5% interception rate by systems like Arrow, Patriot, or THAAD. Independent experts caution that such figures are probably inflated by propaganda. Nonetheless, even a small number of leakers can have devastating effects, as shown in the recent conflict.

Building on Fattah-1, Iran introduced an improved hypersonic weapon, Fattah-2, in late 2023. The Fattah-2 (unveiled in November 2023) retains a similar range of ~1,400–1,500 km but features a more advanced hypersonic glide vehicle warhead. Iranian officials describe Fattah-2 as a two-stage system: a solid-fuel booster (apparently derived from the first-generation Fattah) that lofts a second-stage glide vehicle capable of extreme manoeuvres. This agile warhead, sometimes termed a “Hypersonic Cruise Glide Vehicle (HCGV)” by Iran’s media, can operate both inside and outside the atmosphere and perform sharp turns or altitude changes as it nears the target. Such a flight profile further complicates interception, as the glide vehicle can approach on a non-ballistic trajectory, potentially evading high-altitude exo-atmospheric interceptors. In a bold demonstration, the IRGC reportedly deployed Fattah-2 in combat on 13 April 2024 – marking its first use of a hypersonic missile against an adversary. According to Iranian and some U.S. sources, a Fattah-2 missile struck Israel’s Nevatim Air Base during that clash, destroying a military transport plane, damaging a runway, and wrecking fuel/storage facilities. Another Fattah-2 targeted a second Israeli base in the Negev. If confirmed, this suggests Iran’s hypersonic program has rapidly moved from prototype to operational use in less than a year. (It should be noted that Iran’s claims of Fattah-2’s performance – including reports that it uses a new liquid-propellant sustainer and a 450 kg manoeuvrable warhead – have not been fully independently verified. Western analysts remain cautious, noting that no flight tests were openly documented prior to these combat uses, and some technical details are disputed.)

In addition to hypersonic projects, Iran has developed advanced manoeuvrable medium-range ballistic missiles that blur the line between “conventional” MRBMs and hypersonic weapons. A prime example is the Qassem Bassir (also spelled Qasem Basir), unveiled on 4 May 2025. This missile is essentially an upgraded variant of the earlier Shahid Haj Qasem MRBM (a 1,400 km-range solid-fuel missile first revealed in 2020). The Qassem Bassir retains a medium range of approximately 1,200 km and a ~500 kg warhead, but it incorporates cutting-edge guidance and evasion features. It is a two-stage, solid-propelled missile about 11 m long with an estimated launch mass of ~7 tons. Unlike Iran’s earlier MRBMs, which mostly rely on inertial guidance (and sometimes rudimentary GPS updates), the Bassir carries an electro-optical terminal seeker. Specifically, it is equipped with a thermal imaging camera and an onboard image processing unit that allows it to home in on a target based on a pre-loaded image or heat signature. This means Qassem Bassir can autonomously identify and steer toward, for example, an airbase control tower or a specific hardened shelter in its final dive – without any GPS signal, making it immune to jamming of satellite navigation. In essence, it “sees” its target in the last minutes of flight. Complementing this precision guidance, the Bassir’s re-entry vehicle is a manoeuvrable warhead with small fins that enable it to execute abrupt changes of course during re-entry. It can perform sudden zig-zag or spiralling manoeuvres at supersonic speeds (its impact velocity is around Mach 5) to spoil an interceptor’s firing solution. The missile’s airframe makes heavy use of carbon-fiber composites, which both lighten the structure and reduce its radar signature. All these features – stealthier profile, unpredictable trajectory, and pinpoint accuracy – are intended to maximize the chance of defeating missile defences. Iranian officials have boasted that Qassem Bassir and its kin render even advanced systems like the U.S. Patriot, THAAD, or Israel’s Arrow “largely ineffective,” claiming an adversary might intercept only ~5% of inbound Bassir warheads. While such precise figures should be viewed with skepticism (as analysts note, Iran’s military rhetoric often inflates its capabilities), the Bassir undeniably poses a significant new challenge. It represents a shift from Iran’s earlier strategy of relying on sheer volume of fire (massed salvos of less accurate missiles) toward a focus on missiles that can penetrate defences and strike key targets with precision.

Implications: The emergence of Fattah hypersonics and manoeuvrable MRBMs like Qassem Bassir has several far-reaching implications:

Speed & Evadability: These systems travel at extreme velocities (terminal speeds ranging from about Mach 5 up to Mach 15), which compresses the engagement window for defenders to just seconds. Interceptor batteries must fire multiple rounds in quick succession (or attempt early intercepts in space) to have any hope of hitting such fast warheads. The high speed also means the kinetic impact alone is devastating even if the warhead is conventional.

Trajectory Complexity: Unlike traditional ballistic missiles that follow a predictable parabolic trajectory, missiles with MaRVs or glide vehicles can alter course in mid-flight. This complicates the algorithms behind Israel’s Arrow, David’s Sling, and Iron Dome systems, which rely on predicting an incoming missile’s path. Sudden manoeuvres can cause interceptors to miss or force defensive systems to re-acquire targets at lower altitudes with little time to spare.

Layered Defence Saturation: Iran’s combination of older rockets and these new advanced missiles creates a layered offensive threat. In a future conflict, Iran could launch volleys of routine SRBMs and cruise missiles to occupy Iron Dome and David’s Sling, then follow up immediately with a handful of hypersonic or optical-guided missiles aimed at slipping through Arrow-3/4 or Patriot while the defences are overwhelmed. This layered attack strategy greatly increases the odds of a successful strike on high-value targets.

Psychological and Deterrence Effect: Simply the knowledge that Iran can potentially defeat high-end defences alters the deterrence equation. Israel can no longer assume its Arrow-2/3 interceptors and American-supplied Patriots will catch all inbound missiles. Even one nuclear-capable missile getting through would be catastrophic. This uncertainty strengthens Iran’s deterrence by punishment – dissuading adversaries from striking Iran in the first place for fear of what even a limited retaliatory salvo might do.

In short, the Fattah hypersonic program and Qassem Bassir missile underscore Iran’s ambition to outpace and outwit the layered missile defences in the region via speed, stealth, and manoeuvrability. These developments signal a strategic shift: Iran is supplementing its traditional strategy of mass rocket barrages with a new generation of precision “front-door” penetrators capable of striking heavily defended targets.

Combat Deployment: True Promise III

Iran’s June 2025 retaliation (Operation True Promise III) was the most ambitious missile campaign Tehran has ever executed against Israel. Over two nights, the IRGC launched a mix of ballistic and cruise missiles alongside swarms of attack drones, in an attempt to overwhelm Israel’s air defences. According to Reuters and Israeli sources, Iran fired at least two waves of ballistic missiles on the night of 13–14 June, likely totalling somewhere under 100 missiles in all (mostly Shahab-3/Ghadr types, with some Sejjil or Haj Qasem missiles), plus around 100 drones approaching from multiple directions. Iran’s state media, however, claimed that “hundreds” of missiles were launched in the salvo – a reflection of Tehran’s propaganda but also possibly counting shorter-range rockets from Lebanon or Yemen. The Iranian missile barrage targeted key cities across Israel: missiles rained down around Tel Aviv, Jerusalem, Haifa, and strategic sites such as airbases and infrastructure hubs. Israeli missile defences were pushed to their limits: Arrow-3 batteries engaged high-flying warheads over central Israel, David’s Sling mid-range interceptors targeted incoming medium-range missiles, and Iron Dome units countered drones and short-range rockets. Dozens of aerial interception trails were visible in the night skies above Tel Aviv, and U.S. defence systems (including an American warship in the Mediterranean equipped with Aegis interceptors and a THAAD battery in the UAE) were also activated to assist Israel.

Despite these efforts, a small but significant number of Iranian projectiles breached Israel’s defences. On the first night (13 June), at least 3 Israelis were killed when missiles struck residential areas in Ramat Gan and the Tel Aviv suburbs. The next day (14 June), Iran intensified the assault with more accurate missiles (possibly including a few Qassem Bassir or Fattah units). One warhead slammed into an apartment block in Bat Yam (south of Tel Aviv), causing it to partially collapse – an attack that killed 7 civilians, including three children, and injured over 200 people in the area. Another missile hit near Rehovot, killing an elderly woman and her grandson. By 15 June, Israeli authorities tallied 11 dead and more than 200 injured in the missile onslaught. (This toll does not count several dozen Gaza and West Bank Palestinians who were killed by errant interceptors or falling debris, nor the substantial damage to buildings.) Among the Israeli casualties were multiple children – a fact that underscored the unprecedented nature of this attack to the Israeli public, which had never before experienced a large-scale Iranian missile strike on its home front.

From a military perspective, True Promise III provided a sobering proof of concept for Iran’s missile doctrine. While the vast majority of incoming missiles and drones were successfully intercepted or failed to hit populated areas, enough got through to inflict real pain – demonstrating that Israel’s air defences, as robust as they are, are not impermeable. Israeli defence officials later acknowledged that their systems faced “saturation-level” stress during the peak of the barrages, especially when missiles came in simultaneous volleys from different directions. Notably, Israeli radars struggled to track a subset of missiles that manoeuvred in the atmosphere; one senior officer cited by local media believed that at least 2–3 hypersonic or MaRV-type warheads evaded interception. These advanced projectiles, possibly Fattah or Bassir missiles, were likely responsible for the worst hits (e.g. the Bat Yam impact) – highlighting the danger such systems pose. In addition, Iran’s extensive use of decoys and drones in conjunction with missiles complicated Israel’s defence. The IRGC sent dozens of Shahed-136 loitering munitions and other UAVs to penetrate low-altitude gaps and force Israeli gunners to split their attention. One of these drones managed to strike an IDF radar site in the Negev, according to Iranian media, though Israel did not confirm this.

The missile exchange also showcased Iran’s logistical capability to conduct sustained strikes. Over 150 missiles were launched in total during the two-night operation (as estimated by Western intelligence), indicating Iran has both the stockpiles and the organizational control to coordinate large salvos. However, it also exposed limitations: by the third day, Iran’s firing rate diminished, suggesting the IRGC may have needed time to reposition launchers or was running low on ready-to-fire units. In sum, Operation True Promise III demonstrated that Iran’s missile force – while not able to destroy Israel – can impose significant costs and fear on Israel’s population in a conflict. It put Israel’s much-heralded multi-layer defence to the fiercest test in its history, and proved that some of Iran’s newest missiles are indeed capable of defeating those defences under certain conditions.

(It should be noted that Iran’s leadership portrayed True Promise III as a proportionate retaliation for Israel’s “declaration of war” in Operation Rising Lion. Iranian officials stressed they targeted military sites and infrastructure; however, the reality of missiles hitting civilian areas undercut Tehran’s claims of restraint. International observers, including the UN, sharply condemned the missile attacks on cities as unlawful. Still, domestically, the operation was a propaganda win for Iran, with media highlighting images of burning buildings in Tel Aviv and asserting that Iran had “shattered the myth” of Israeli invincibility.)

Infrastructure and Survivability

A critical factor in Iran’s missile prowess is how well its arsenal is protected and concealed. Over decades, Iran has invested heavily in fortifying its missile infrastructure against aerial attack – building a network of hardened sites often referred to as “missile cities.” These are sprawling underground bases, sometimes 500 m or more below ground, containing tunnels, storage bunkers, launch silos, and command centres. Video releases by the IRGC have shown tunnels packed with TEL vehicles and missiles on mechanized rails, hidden behind blast doors in mountain sides. Iran claims to have dozens of such facilities across different provinces (especially in the Zagros mountain range and coastal regions), enabling it to ride out enemy air attacks and still retaliate. Key known missile bases are located near Khojir (east of Tehran, a major missile production and testing hub), in Kermanshah and Lorestan provinces (where several missile units are stationed to cover western Iran), around Isfahan, and along the Persian Gulf coast (to threaten U.S. bases and shipping). These installations are typically shielded by multiple layers of concrete and earth – satellite imagery shows reinforced tunnel entrances and underground storage for missiles and fuel. Iran has also colocated some missile sites with its integrated air-defence units (including Russian-supplied S-300 and domestic Bavar-373 SAM systems) to provide local air defence cover.

During Israel’s Operation Rising Lion strikes in June 2025, many of Iran’s above-ground missile launch sites and depots were targeted. The Israeli Air Force attacked launch brigades in western Iran, hitting what it believed were active TELs and logistical trucks. For example, satellite intelligence indicated that two buildings at the Khojir missile complex used for producing solid rocket propellant were destroyed by precision bombs. Strikes were also reported near Kermanshah, where Israel claimed to have blown up several mobile launchers in their hide sites. Additionally, covert attacks in the months prior – attributed to Mossad – had sabotaged some missile fuel infrastructure (one such drone strike in Isfahan, in 2024, reportedly wrecked a production line for missile guidance systems). Despite these efforts, Israel found that Iran’s missile enterprise proved resilient. Most of the missile cities are so deeply buried that bunker-buster bombs only sealed some tunnel entrances at best, without destroying the contents inside. Iran was able to continue launching missiles even after Israel’s initial wave of attacks, by quickly shifting to backup launch sites and bringing reserve units to readiness. Western observers noted that Iran dispersed many TELs to new locations (including using civilian trucks as decoys) once the war began, making it very hard for Israel to locate and eliminate all of them. Indeed, an analysis of the June 2025 campaign concluded that Israel’s strikes delivered only minor setbacks to Iran’s missile order of battle – knocking out perhaps a few dozen missiles in storage and a handful of launch vehicles, but not coming close to neutralizing Iran’s overall capability. The underground bases remained largely intact, and Iran’s missile units preserved enough strength to keep firing throughout the conflict.

This cat-and-mouse dynamic highlights the challenge Israel (or the U.S.) would face in any attempt at a pre-emptive “missile hunt” in Iran. As one Israeli analyst lamented, “We can hit what we can see – the launch trucks in the open – but we cannot reach hundreds of missiles buried under mountains”. Even facilities that are destroyed can often be repaired or bypassed; for instance, Iran’s solid-fuel production may have been disrupted by strikes on Khojir, but the IRGC likely had duplicate plants or stockpiles to draw upon. Iran’s extensive use of decentralization and redundancy – storing missiles in numerous sites and having multiple launch crews – means that no single strike (short of a massive nuclear attack) could cripple its missile force outright. This survivability through hardening and mobility is a cornerstone of Iran’s deterrent strategy. It ensures that Iran retains a “second strike” capability: even under intensive bombardment, enough launchers and missiles will survive to retaliate. This was clearly demonstrated in the 2025 conflict, where Israeli defence officials admitted that Iran’s missile firing capacity was dented but not knocked out by the Rising Lion operation. In fact, Iran continued unveiling new underground sites even amidst the hostilities – in late March 2025, Iranian state media showed Generals Bagheri and Hajizadeh touring a previously secret underground base storing Ghadr, Emad, Sejjil, and Haj Qasem missiles in vast tunnels. This was both a propaganda message and a real signal: Iran’s missile arsenal can endure bombardment and still pose a lethal threat.

In practical terms, this means Israel would likely have to launch multiple waves of strikes over a prolonged period to significantly degrade Iran’s missile forces – an effort that risks expansion into full war. And even then, completely eliminating the threat would be exceedingly difficult as Iran can rebuild and replace what it loses. The June 2025 exchange thus underlined a stark reality: so long as Iran can shelter its missiles in secure locations and deploy them nimbly, it will retain a potent ability to hit back at aggressors.

Strategic Implications and Outlook

The events of mid-2025 have fundamentally altered the strategic calculus in the Middle East with respect to missile warfare and defence. Iran’s rapid evolution from a force reliant on inaccurate Scud-type missiles and proxy rockets into one fielding precision-guided, manoeuvrable, and hypersonic weapons is a game-changer. Below are key strategic implications of this shift and an outlook for the future:

1. Erosion of Israel’s Deterrence Edge: The credibility of Israel’s layered missile defence – Iron Dome for short-range threats, David’s Sling for medium-range, and Arrow-2/3 for long-range ballistic missiles – has been shaken. These systems, while still highly effective, can no longer be assumed to intercept every inbound missile. The introduction of hypersonic and MaRV-equipped missiles means even a few leaks are plausible in any engagement. As a result, Israel (and its U.S. ally) must now reckon with the fact that Iranian missiles could inflict unacceptable damage in a war, reducing the temptation to launch or escalate conflicts. In strategic terms, Iran’s advances strengthen its deterrence posture: by holding at risk critical Israeli infrastructure (like airbases, power plants, and population centres) with missiles that might penetrate defences, Iran raises the potential costs of pre-emptive action against it. This “balance of terror” pushes Israel more toward defence and damage limitation, and bolsters Tehran’s hand in any brinksmanship. Put simply, Israel can no longer assume that offense will be low-risk or that its citizens are fully shielded; this may make Israeli leaders more cautious in confronting Iran directly.

2. Escalation and Crisis Instability: The perceived inability to block Iran’s new missiles could actually make conflicts more unstable. Facing a threat that their defences might not cope with, Israel’s leadership could feel pressure to act earlier and more massively in a crisis – including contemplating pre-emptive strikes on missile launchers or even on Iranian leadership – to prevent a worst-case scenario. Iran, aware of this, might also adopt a “use them or lose them” approach with its high-end missiles in a crisis, launching quickly before Israel can destroy them on the ground. The result is a classic hair-trigger situation. The hypersonic threat compresses decision-making timelines: for example, a Mach 15 Fattah could hit Tel Aviv from western Iran in under eight minutes, giving very little warning or chance for diplomacy once launched. In any future flare-up (be it over Syria, Lebanon, or nuclear tensions), the existence of these weapons increases the risk that either side might escalate to missile strikes sooner, rather than later, out of fear that waiting could be even more dangerous. This dynamic is inherently destabilizing – a single incident or miscalculation could rapidly spiral into a large-scale exchange of fire before outside powers can intervene. Thus, crisis instability is heightened: both Israel and Iran have strong incentives to be ready to shoot early if they believe conflict is imminent.

3. Intensified Arms Race and Defence Collaboration: Iran’s missile breakthroughs are already spurring its adversaries to upgrade their defences and cooperate more closely. Israel, the United States, and Sunni Arab states (like the Gulf states and Saudi Arabia) have a common interest in countering Iranian missiles. We can expect accelerated development and deployment of next-generation interceptors such as Arrow-4 (a program Israel and the U.S. have been working on to improve intercepts of emerging threats) and possibly even an Arrow-5 down the line. Israel has also begun exploring non-kinetic defences: in June 2025, Rafael Advanced Defence Systems publicly unveiled a concept called “Sky Sonic,” an air-defence interceptor specifically designed for hypersonic missiles. Concurrently, there is renewed interest in directed-energy weapons (high-powered lasers) that could engage missiles during boost or terminal phase – technology that might still be years off, but which offers an attractive solution to fast manoeuvring targets. On the multilateral front, the Abraham Accords countries and other regional partners may link their radar early-warning networks and share real-time tracking data, effectively creating a broader missile defence umbrella. The United States has already indicated it will support such integration, and has moved assets like THAAD batteries and Aegis ships to the Middle East as a backstop. This burgeoning missile defence alliance is not without cost: it will drive significant expenditure (as interceptors like Arrow-3 or THAAD cost millions apiece) and could provoke Russia or China to step in with more advanced missile tech for Iran in response. Nonetheless, we are likely to see a regional arms race where for each new Iranian offensive capability, a new defensive countermeasure is pursued – and vice versa, as Iran then develops penetration aids to defeat that defence.

4. Enhanced Iranian A2/AD Leverage: Beyond the Israel confrontation, Iran’s hypersonic and long-range missiles greatly boost its anti-access/area-denial (A2/AD) capabilities against U.S. and allied forces in the Gulf region. A weapon like Fattah, launched from deep inside Iran, could threaten forward bases (Al Udeid in Qatar, Al Dhafra in UAE) or even U.S. carrier strike groups at sea, within minutes. Such missiles fly faster and lower than traditional MRBMs, potentially evading ship-based radars until the last moments. The mere deployment of these systems forces the U.S. Navy to stand off at greater distances and complicates calculations for any intervention. In a crisis over the Strait of Hormuz or Iranian nuclear facilities, hypersonic missiles give Iran added confidence that it could deliver a painful blow to high-value assets (like an aircraft carrier or regional HQ) if attacked. This strengthens Iran’s hand in deterrence by denial – dissuading adversary movements in its near abroad. For instance, Western military planners will have to incorporate the risk of hypersonic missile attack when timing reinforcements or carrier deployments to CENTCOM. In effect, Iran is attempting to impose a kind of no-go zone or heightened risk zone around its periphery, leveraging these missiles as a strategic shield for its airspace and coastal waters. Over time, as Iran potentially refines these systems (or even develops longer-range versions), its ability to hold at risk targets across the Middle East will only increase, thus extending its strategic depth.

5. Need for Diplomacy and Arms Control: The developments in Iran’s missile arsenal by mid-2025 underscore the urgency for renewed diplomatic efforts – yet they also make the prospect more challenging. With Iran feeling emboldened by its improved deterrent, it may be less inclined to concede limits on its missile program. International negotiators (e.g., in a revived JCPOA framework) would likely seek to address at least the range or payload of Iran’s ballistic missiles, but Tehran has consistently rebuffed missiles-related talks, considering them vital to national defence. Without some form of missile risk-reduction agreement, the region faces a future of continued brinkmanship and possibly miscalculation. Confidence-building measures – such as advance notifications of missile tests, or geographical range limits (e.g., Iran could voluntarily cap operational missile range at 2,000 km as it once declared) – could help, but trust is low on all sides. Meanwhile, Israel might double-down on covert action to sabotage Iran’s most dangerous missile projects, which carries its own risks of escalation. The mid-2025 conflict may serve as a wake-up call: absent new diplomatic initiatives or arms control, the Middle East seems poised on a knife’s edge defined by periodic missile exchanges and high-stakes deterrence. The cycle of action and reaction (Iran improving missiles; Israel improving defences and considering strikes) is likely to continue.

In summary, Iran’s missile advancements – vividly demonstrated in the Rising Lion/True Promise III confrontation – are reshaping regional security. They have emboldened Iran by giving it a more credible retaliatory punch, while exposing gaps in even the best defensive systems. All actors in the region are now adjusting to this new reality. Barring a significant easing of hostilities or an unlikely arms control breakthrough, the post-2025 Middle East may be characterized by a persistent missile-driven standoff, where both sides possess the ability to seriously hurt the other, and each crisis carries the dread of rapid escalation. It is a perilous strategic balance, one that will require prudent management, technological innovation in defence, and hopefully renewed diplomatic dialogue to prevent catastrophe.

Sources:

Associated Press: Israel strikes on Iran’s nuclear sites and Iran’s retaliation. apnews.com

Reuters: Details on Iran’s missile retaliation and Israeli defence performance. reuters.com

The Guardian (live coverage): Israeli casualties and missile impacts in June 2025. theguardian.com

Times of Israel: Reports of Israeli fatalities and injuries from Iranian barrages

Iran Watch / CSIS Missile Threat: Specifications of Iran’s SRBMs/MRBMs (ranges, payloads, fuel types). iranwatch.org

Defence Industry Europe: Analysis of Fattah-1 hypersonic missile’s design and capabilities. defence-industry.eu

Press TV and Army Recognition: Iran’s unveiling of Fattah-2 hypersonic missile and reported use in 2024 strike

Janes & Defencemirror: Qassem Bassir missile’s range, guidance (electro-optical seeker), and claimed intercept evasion rate. janes.com defensemirror.com

Breaking Defence: Expert commentary on challenges hypersonic missiles pose to Arrow/THAAD and new Israeli countermeasures like “Sky Sonic”

Wikipedia (Iranian underground missile bases): Information on Iran’s “missile cities” and hardened launch infrastructure

SOFREP Analysis: Efficacy of Israeli strikes on Iran’s missile facilities and limitations in targeting underground sites. sofrep.com